Payroll – how should I manage payroll as a small business owner?

Payroll can be a complex area of bookkeeping for beginners. Often small business owners don’t realize the amount of work that’s needed to complete payroll to the required standard.

There are many different factors that can catch people out, including Tax allocations, new ATO requirements, and pay rate changes. There’s also the fiddly task of how to enter a payslip, and all the elements required to do this to the required standard.

Here we explore what it takes to get a payslip ready, and the different stages that you might need to think about as a small business owner.

Casual Vs Permanent Employees

Let’s start with the basics. You need to look at your company and decide whether you want to hire workers as either casual or permanent employees, and how many standard hours per week your employee will work. A casual employee will only receive the Gross earnings plus Super, and they do not accrue any annual leave.

On the other hand, the permanent employee will accrue annual leave, sick leave, and long service leave, but the pay rate is lower compared to a casual worker. In reality, the rates usually end up being the same, with a difference of a few dollars per hour.

You will also need to think about how you will pay your employees. Will you be using an award or a contract? An award falls under fairwork guidelines on how to pay, what to pay, and the rules behind what the employee receives from you. This ensures that you are always paying the correct amount to your employees, with the award pay rates increasing every year depending on your industry.

Once you have determined these initial factors, you can sign up an employee and enter them into your accounting system.

Super & Minors

A new rule for Superannuation has recently come into play, meaning that everyone now receives Superannuation as standard. There are exceptions to this, for example when employees are under 18 and work less than 30 hours per week. As someone in charge of payroll, you will need to determine if they are eligible for Super to avoid paying more than you need to.

Taxes

When it comes to choosing which tax threshold to use, you must first determine the employee’s circumstances. Rather than doing this yourself, it is usually easier to let the employee advise you. If they want to claim the tax-free threshold and have a help debt then they will let you know. You can then need to allocate it in the taxes area.

Pay Items

Next, you will have to allocate payroll categories. These are pay items that have individual rules, so if someone earns an amount different from the base salary, you will need to use a separate category. For example, if you work a Saturday and receive 1.5 times your base rate then you can set up this pay item to use this formula.

You will also need to create pay items for Salary Sacrifice, RDO Entitlements, and deductions. The Super area, which we explored above, is problematic due to the multiple rules on whether you are sacrificing Super before tax, after tax, or whether it is an employee additional Super, or employer additional Super. On top of this, you need to ensure that annual leave only accrues on the correct pay items and Super.

Leave Accruals

Overtime doesn’t accrue Super or annual leave amounts, as this is not classed as ordinary earnings. You will come across a lot of these items for input, and you will need to make sure you know what accrues and what doesn’t. Without this, you may find yourself paying a lot more in Superannuation or annual leave.

Pay Runs

When it comes to creating a payslip, you can prepare a new payrun, and choose the date range and payment date. The payment date is very important as this date determines when you pay the PAYG, Super, and which financial year the pay falls into. For example, if your employee works from 25th June to 30th June, but is paid on the 1st July, then the pay will flow into the following year as it is based on the payment date.

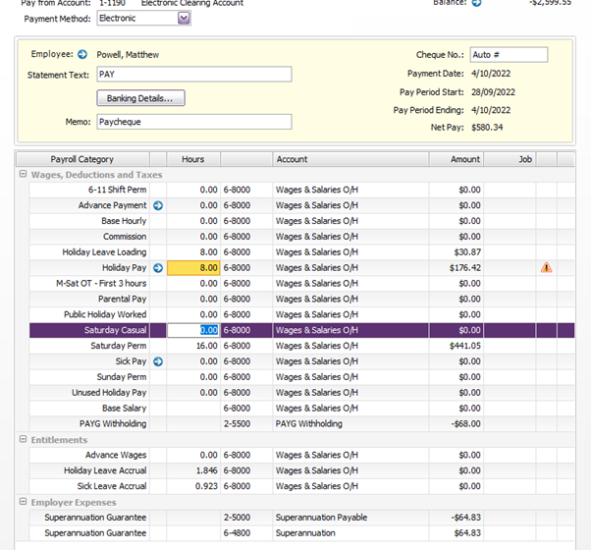

Below is an example of a payrun. You can see the annual leave accruing on the hours we have entered, and also the PAYG and Super have automatically been input.

When it comes to paying the employee, you can pay manually from your bank account, or most accounting systems allow you to create an ABA file. This lets you group multiple employees together to pay them without needing to manually enter any data.

3rd Party Systems

There are other 3rd party systems you can use as well, for example, Deputy, which tracks the hours worked. You can then integrate this with your accounting package so all the hours are automatically pulled through. These will come through as timesheets, which you can use to record hours and allocate them to areas or jobs. This lets you determine the wage cost on each job, allowing the timesheets to flow into a payslip for processing.

Although we have raced through a lot of areas within payroll that should help you, it does take a true professional to handle this area properly. If you’re not experienced with these matters, doing payroll for the first time can be more time and trouble than it’s worth. You can get expert assistance from us at Client’s Needs Bookkeeping, so contact us today for a complete service that will take the headache out of payroll.